Ponzi schemes are sophisticated fraud mechanisms that promise high returns with little risk, using money from new investors to pay earlier investors, creating an illusion of a profitable business. Here’s an expanded exploration of how to detect and avoid these scams, safeguarding your financial interests. Understanding Ponzi Schemes

History and Background

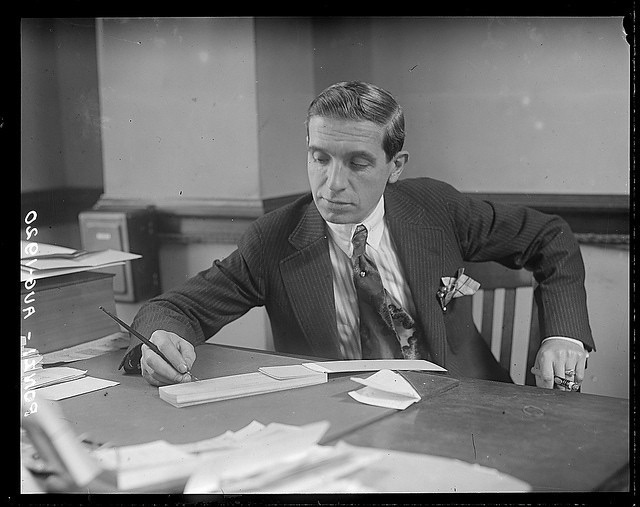

The Ponzi scheme gets its name from Charles Ponzi, who in the early 20th century, used the promise of hefty profits within short periods to attract investors into a postage stamp speculation scam. Ponzi’s original scheme promised that he could double investors’ money within three months. However, the returns were paid from incoming funds from new investors, not legitimate business activities. This model is unsustainable and is destined to collapse once the flow of new investor money stalls.

Case Study: Bernie Madoff

Perhaps the most infamous modern example is Bernie Madoff, who orchestrated a Ponzi scheme that defrauded thousands of investors out of billions of dollars. Madoff’s scheme unraveled during the financial crisis of 2008, when many investors attempted to withdraw their money simultaneously, revealing the lack of actual returns.

Mechanism of Operation

Ponzi schemes depend on a continuous influx of money from new investors to continue operating. Initially, these schemes pay high returns to early investors using the money of newer investors, which encourages both new and old participants to invest more money. Over time, as it becomes harder to recruit new investors and the pyramid of existing investors grows, the scheme collapses under its own weight, often leaving most participants with significant losses.

The Role of Psychological Manipulation

Operators of Ponzi schemes often exploit the psychological biases of investors, such as greed, fear of missing out, and trust. By creating a sense of exclusivity and urgency, they compel investors to act quickly without performing due diligence. Understanding these psychological traps can be the first step in avoiding such scams.

How to Detect a Ponzi Scheme

Promises of High Returns with Little or No Risk

One of the most significant red flags of a Ponzi scheme is the promise of extraordinary returns while claiming minimal to no risk. The basic principle of investing is that higher returns require higher risks. Any investment claiming to deviate from this principle is likely fraudulent or highly misleading.

Example: Consider an investment opportunity offering a consistent 20% annual return with no risk. In the real world, such high returns are typically associated with high-risk ventures, and the promise of “no risk” should immediately raise suspicions.

Overly Consistent Returns

Investments are subject to market conditions and will show volatility that reflects these conditions. An investment that produces consistently positive returns irrespective of economic and market conditions should be a potential sign of fraud. Genuine investments typically have periods of poor performance, which are absent in Ponzi schemes.

Real-World Insight: If you were to examine a legitimate mutual fund’s performance, you’d see fluctuations that mirror market trends. A Ponzi scheme, however, will show a suspiciously stable upward trajectory regardless of external factors.

Secretive or Complex Strategies

Operators of Ponzi schemes often cloak their activities in secrecy or complex financial terminology that is difficult to understand. They may discourage questions with dismissive remarks about the complexity of the strategies involved. Transparency is key in any legitimate investment; if the operator is unwilling to share clear, understandable information about how your money is being used, it’s a strong indicator of potential fraud.

Tip: Request a clear breakdown of the investment strategy. If the explanation is full of jargon and lacks substance, consider it a warning sign. Legitimate financial advisors should welcome questions and provide straightforward answers.

Issues with Paperwork

Discrepancies in investment statements or documents can be an early indicator of a Ponzi scheme. Investors might notice unexplained account discrepancies or receive statements that reflect unexpected results. Errors in financial documents can suggest that funds are not being managed properly or, worse, misappropriated.

Practical Advice: Regularly review your account statements. Watch for inconsistencies or unexpected changes in your account balance. If something doesn’t add up, demand clarification.

Difficulty Receiving Payments

A classic sign of a Ponzi scheme nearing its collapse is when payments to investors are delayed or recipients are encouraged to reinvest their money rather than cash out. Operators may explain these delays with excuses about financial market problems or issues in bank transfers, usually urging investors to stay patient to avoid unraveling the scheme prematurely.

Example: If you request a withdrawal and are met with delays or pressure to reinvest, consider this a significant red flag. Legitimate investments should allow you to access your funds without hassle.

How to Avoid a Ponzi Scheme

Research the Investment and the Investment Professional

Investors should verify the legitimacy of both the investment and the person offering it by checking their registration with relevant authorities like the SEC or FINRA. This research includes looking at the investment’s and advisor’s historical performance, reputation, and the authenticity of their claims.

Case Study: Before investing, consider the due diligence performed by savvy investors who avoided Madoff’s scheme by questioning his refusal to undergo an independent audit.

Ask Questions

Do not hesitate to ask detailed questions about the investment strategy, expected returns, risks, and fees. A credible financial advisor should be transparent and willing to provide clear, comprehensive answers. Vague responses or reluctance to answer questions fully are a major warning sign.

Advice: Prepare a list of questions before meeting an investment advisor. If they seem evasive or annoyed by your inquiries, it’s time to reassess your options.

Verify Returns with Independent Third Parties

Independent verification of investment returns from a third-party can prevent falling for falsified success claims. This includes reviewing audited financial statements, confirming trade tickets, or using regulated and reputable platforms for viewing investment performance.

Example: Look for investments that are backed by third-party audits conducted by reputable firms. This adds a layer of security and transparency that Ponzi schemes cannot provide.

Be Skeptical of Unsolicited Offers

An unsolicited investment offer, especially one that promises a quick profit, is often the first step in a potential Ponzi scheme. Always approach such offers with skepticism and conduct due diligence rather than allowing the fear of missing out to influence financial decisions.

Advice: Treat any cold-calling investment proposal as a potential scam until proven otherwise. Legitimate firms rarely resort to unsolicited pitches to gain clients.

Know Where Your Money Goes

Understanding how and where your money is being invested is crucial. Request regular and detailed reports, and verify these by comparing them with market data or other reliable financial information sources. If the investment vehicle is opaque or your money is pooled into an undefined fund without adequate explanation, this should raise serious concerns.

Tip: Regularly cross-check your investment’s performance with independent financial news sources. Discrepancies between reported performance and market conditions should be questioned.

The Role of Regulatory Bodies

Understanding Regulatory Protections

Regulatory bodies like the SEC and FINRA play a critical role in protecting investors by enforcing securities laws and scrutinizing financial firms. Ensuring that your investment professional is registered with these bodies provides an additional layer of security.

Example: Madoff’s scheme went undetected for years partly because of insufficient regulatory oversight. Today, increased scrutiny can help catch such schemes earlier.

Reporting Suspicious Activity

If you suspect a Ponzi scheme, report your concerns to the appropriate regulatory bodies. They have the resources and authority to investigate and potentially shut down fraudulent operations.

Practical Tip: Keep a record of all communications and transactions related to the suspicious investment. This documentation can be invaluable during an investigation.

Common Mistakes and How to Avoid Them

Ignoring Red Flags

Many victims of Ponzi schemes admit to noticing red flags but chose to ignore them, often due to the allure of promised returns. Cultivating a mindset of skepticism can prevent costly mistakes.

Advice: Trust your instincts. If something feels off, it probably is. Always err on the side of caution.

Overlooking Documentation

Failing to maintain detailed records can make it difficult to recover funds or provide evidence if fraud is suspected. Ensure you keep comprehensive documentation of all investment activities.

Tip: Create a dedicated folder for all investment-related documents. Regularly update this folder and review its contents.

The Aftermath of a Ponzi Scheme

Steps for Recovery

While recovering lost funds from a Ponzi scheme can be challenging, there are steps victims can take. Engage with legal professionals to explore options for restitution and participate in any class-action lawsuits.

Example: Following the exposure of Madoff’s scheme, a significant fund recovery effort was launched, resulting in the return of billions to defrauded investors.

Emotional and Financial Impact

Beyond financial loss, falling victim to a Ponzi scheme can have severe emotional repercussions. Seeking support from financial advisors and mental health professionals can aid in the recovery process.

Advice: Don’t hesitate to reach out for help. Emotional support and professional guidance can be crucial in regaining financial stability and peace of mind.

Investing should be a careful and calculated decision-making process. By staying informed and vigilant, you can protect yourself from the potentially devastating effects of Ponzi schemes. Remember, if an investment opportunity seems too good to be true, it’s worth taking a closer look—or walking away altogether.