When it comes to managing your finances and understanding your creditworthiness, two key terms often come up—credit report and credit inquiry. These terms are crucial in the world of credit and can impact your financial well-being. Let’s delve into the intricacies of these concepts to gain a comprehensive understanding. A credit report is a detailed record of an individual’s credit history. It contains information on the individual’s borrowing history, including details on credit accounts, payment history, outstanding balances, and any public record information such as bankruptcies or liens. The credit report is compiled by credit bureaus based on data provided by creditors and other sources. Lenders, landlords, and potential employers often use credit reports to assess an individual’s creditworthiness and reliability. Having a comprehensive and accurate credit report is crucial as it plays a significant role in shaping financial decisions and opportunities. It serves as a snapshot of an individual’s credit management habits and financial responsibility over time.

The Anatomy of a Credit Report

A credit report can seem like a labyrinth of information at first glance, but understanding its structure can make it more navigable:

- Personal Information: This section includes your name, address, Social Security number, and date of birth. It’s critical to ensure that this information is accurate to avoid mix-ups with another person’s credit history.

- Credit Accounts: Also known as trade lines, this section lists all your credit accounts. It includes details about the type of account (credit card, mortgage, etc.), the date it was opened, credit limit or loan amount, account balance, and payment history.

- Credit Inquiries: This part of your report details all the entities that have accessed your credit report. It distinguishes between hard and soft inquiries, which we’ll discuss further.

- Public Records and Collections: Negative information such as bankruptcies, foreclosures, and any debts sent to collections appear here. This information can significantly impact your credit score.

- Credit Score: Though not always included, some reports may show your credit score, a numerical representation of your creditworthiness.

How to Maintain a Healthy Credit Report

Maintaining a healthy credit report involves consistent effort and vigilance. Here are some practical steps:

- Regularly Review Your Credit Report: By law, you are entitled to a free credit report from each of the three major credit bureaus—Equifax, Experian, and TransUnion—once a year. Utilize websites like AnnualCreditReport.com to access these reports. Regular reviews help you spot errors or signs of identity theft early.

- Dispute Inaccuracies: If you find errors, such as an account you don’t recognize or incorrect personal information, dispute them immediately. You can do this online or via mail with the credit bureau that issued the report.

- Timely Payments: Your payment history is a significant factor in your credit score. Set up reminders or automatic payments to ensure bills are paid on time.

- Manage Debt-to-Credit Ratio: Try to keep your credit card balances low relative to your credit limits. A high debt-to-credit ratio can negatively impact your score.

- Limit New Credit Applications: Each new application can lead to a hard inquiry, which might lower your score temporarily.

A credit inquiry, on the other hand, refers to a request made by a third party to review an individual’s credit report. There are two types of credit inquiries—hard inquiries and soft inquiries. Hard inquiries occur when a lender reviews an individual’s credit report in response to a credit application, such as applying for a loan or credit card. Hard inquiries can have a temporary negative impact on a credit score, as they indicate that the individual is actively seeking credit. On the other hand, soft inquiries occur when an individual checks their own credit report or when a potential employer or lender performs a background check for informational purposes. Soft inquiries do not impact credit scores and do not signal an individual’s intent to seek new credit. It is important to be aware of the types of inquiries being made on your credit report to understand how they may affect your credit score and financial standing.

The Impact of Hard and Soft Inquiries

Understanding the nuances between hard and soft inquiries can help you manage your credit more effectively:

- Hard Inquiries: Usually, when you apply for a loan, mortgage, or credit card, the lender will initiate a hard inquiry. Each hard inquiry can lower your credit score by a few points, but multiple inquiries in a short period could have a more significant impact. However, credit scoring models often treat multiple inquiries for the same type of loan within a specific window as a single inquiry, recognizing that consumers might shop around for the best rates.

- Soft Inquiries: Checking your own credit report, pre-approved credit offers, or background checks by potential employers fall under soft inquiries. These do not affect your credit score, allowing you to monitor your credit health without consequence.

Strategies to Manage Credit Inquiries

Here are some strategies to manage how credit inquiries affect your credit score:

- Be Selective with Credit Applications: Before applying for new credit, evaluate your needs and research the best options. Only apply for credit when necessary and when you’re confident of approval.

- Shop for Rates Within a Short Time Frame: If you’re shopping for loans, do it within a short time frame—typically 14 to 45 days—so that multiple inquiries are counted as one.

- Monitor Your Credit: Regular monitoring helps you stay informed about your credit status and inquiries made. Use credit monitoring services or tools provided by your bank or credit card issuer to get alerts on new inquiries.

Understanding the distinction between a credit report and a credit inquiry is essential for managing your finances effectively. By monitoring your credit report regularly and being mindful of the types of inquiries being made, you can take proactive steps to maintain a healthy credit profile. Regularly reviewing your credit report allows you to spot any errors or inaccuracies that may be negatively impacting your credit score. Additionally, minimizing hard inquiries by being selective about applying for new credit can help preserve your credit score and demonstrate responsible financial behavior to potential lenders.

Remember, a good credit report and minimal hard inquiries can improve your creditworthiness and open up more favorable financial opportunities in the future. Moreover, understanding these concepts not only aids in personal financial management but also empowers you to make informed decisions when engaging with lenders and financial institutions.

Common Mistakes to Avoid

When managing credit, there are common pitfalls that can hinder your financial health. Here are a few to watch out for:

- Ignoring Your Credit Report: Many people overlook their credit reports until they need a loan. Regular checks can help catch issues early.

- Making Late Payments: Late payments can tarnish your credit history for years. Prioritize paying bills on time.

- Maxing Out Credit Cards: High credit utilization can hurt your score. Aim to use no more than 30% of your available credit.

- Applying for Too Much Credit at Once: Each application can trigger a hard inquiry, which can lower your score. Apply sparingly and wisely.

- Not Diversifying Credit: Having a mix of credit types (revolving credit like credit cards and installment loans like mortgages) can positively impact your score.

The Role of Credit Scores

While credit reports provide detailed credit history, credit scores summarize this information into a single number. This number is crucial for lenders assessing risk. Here’s a brief overview:

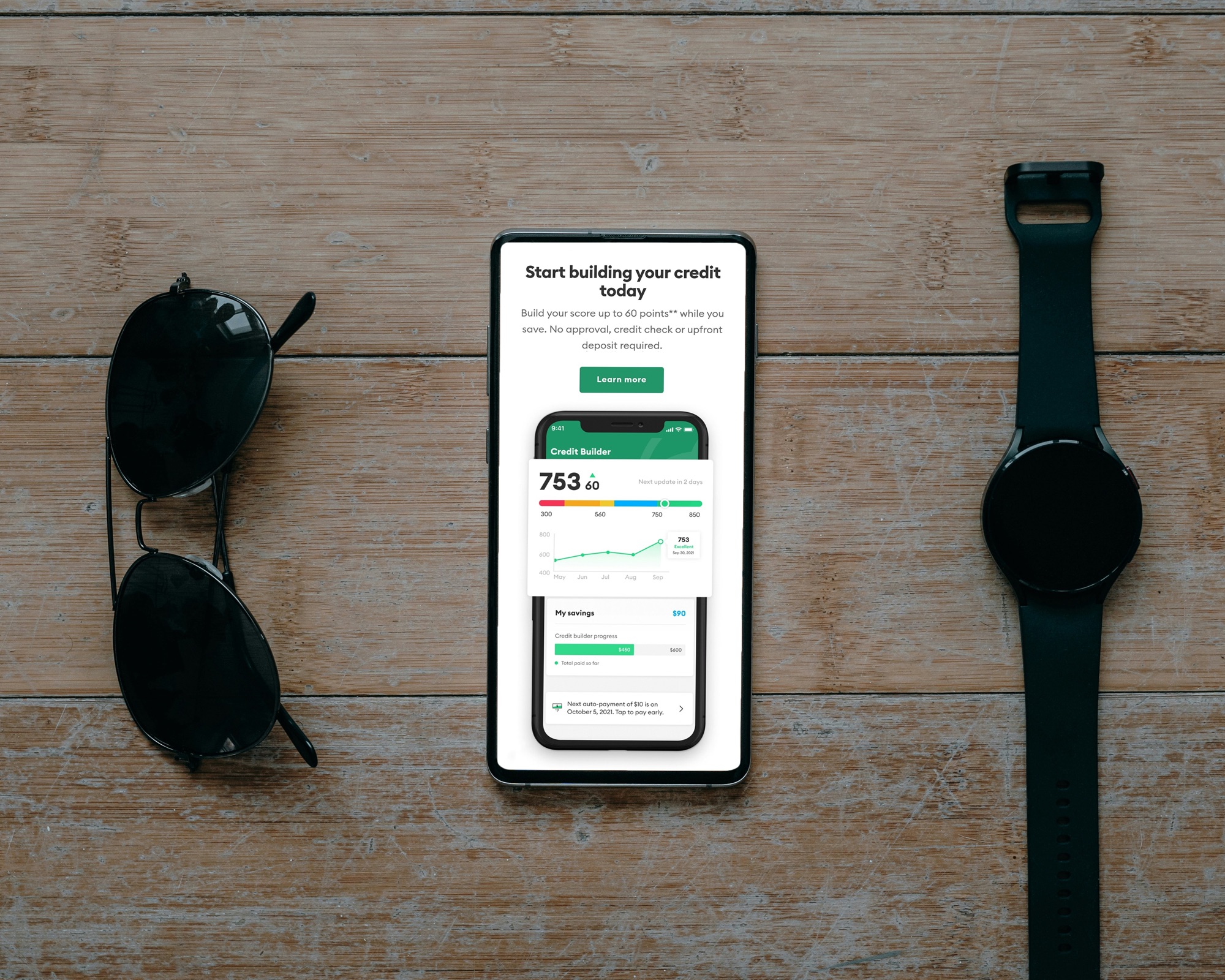

- Range and Meaning: Credit scores typically range from 300 to 850. A score above 700 is generally considered good, while anything above 800 is excellent.

- Factors Affecting Credit Score:

- Payment History: 35% of your score is based on timely payments.

- Credit Utilization: 30% is based on how much credit you’re using compared to your limit.

- Length of Credit History: 15% considers how long you’ve had credit accounts.

- New Credit: 10% is affected by recent applications and inquiries.

- Credit Mix: 10% is based on the variety of credit types you have.

Practical Steps for Improving Your Credit Score

Improving your credit score is a gradual process, but it’s achievable with consistent effort:

- Pay Off Debts Strategically: Focus on paying down high-interest debt first or use the snowball method, where you pay off smaller debts to build momentum.

- Increase Your Credit Limits: If you have good standing with your credit card issuer, request a credit limit increase. Just ensure you don’t increase your spending.

- Become an Authorized User: On a responsible person’s credit card, this can help build your credit history without liability for the debt.

- Use Credit Wisely: Make small, regular purchases that you can pay off each month to maintain active, healthy credit accounts.

By understanding and managing both your credit report and inquiries, you’re better positioned to maintain financial health, secure favorable credit terms, and achieve your financial goals. Developing a keen awareness of how these elements interact is a critical step toward mastering your personal finances.