In the world of investing and finance, terms like stock exchange and stock index are frequently mentioned, often leading to confusion among beginners. While both play crucial roles in financial markets, they refer to different concepts and serve different purposes. Understanding the distinction between a stock exchange and a stock index is essential for anyone looking to navigate the world of investing.

In this article, we will explore the differences between a stock exchange and a stock index, including how they function, their importance in the financial world, and how they interact with each other.

What Is a Stock Exchange?

A stock exchange is a marketplace where buyers and sellers come together to trade securities, such as stocks, bonds, and other financial instruments. It is a physical or digital platform where companies list their shares, allowing investors to buy and sell them. Stock exchanges are essential for facilitating liquidity, price discovery, and transparent trading.

Key Features of a Stock Exchange

- Marketplace for Trading: Stock exchanges provide the infrastructure for trading stocks, bonds, and other securities. Examples include the New York Stock Exchange (NYSE) and the NASDAQ in the U.S., the London Stock Exchange (LSE) in the U.K., and the Tokyo Stock Exchange (TSE) in Japan.

- Listing Requirements: Companies must meet specific criteria to be listed on a stock exchange. These requirements include minimum market capitalization, financial health, and governance standards.

- Regulation and Oversight: Stock exchanges are regulated by government bodies (like the SEC in the U.S.) to ensure fair and transparent trading practices.

- Types of Orders: Exchanges facilitate different types of orders, including market orders, limit orders, and stop-loss orders, enabling investors to control their trades.

- Primary and Secondary Markets: In the primary market, companies issue new shares to the public via initial public offerings (IPOs). In the secondary market, existing shares are traded among investors.

Major Stock Exchanges Around the World

- New York Stock Exchange (NYSE): One of the largest and most well-known exchanges globally, hosting companies like Apple, Amazon, and Microsoft.

- NASDAQ: Known for technology and growth stocks, including companies like Google (Alphabet), Facebook (Meta), and Tesla.

- London Stock Exchange (LSE): The main stock exchange in the U.K., home to global giants like BP and HSBC.

- Tokyo Stock Exchange (TSE): The largest exchange in Japan, listing companies like Toyota and Sony.

Role of Stock Exchanges in the Financial System

Stock exchanges play a vital role in the financial system by providing:

- Liquidity: Allowing investors to easily buy and sell shares.

- Price Discovery: Determining the fair market price of securities based on supply and demand.

- Capital Raising: Enabling companies to raise capital by selling shares to the public.

What Is a Stock Index?

A stock index is a measurement of the performance of a group of stocks that represent a specific segment of the market. It is essentially a statistical indicator that tracks the performance of a particular set of stocks to gauge the overall direction of a market or sector. Investors, analysts, and fund managers use indices as benchmarks to measure the performance of portfolios or the broader market.

Key Features of a Stock Index

- Representation of a Market Segment: Stock indices represent specific segments of the market, such as large-cap stocks, technology stocks, or the overall market. Examples include the S&P 500, the Dow Jones Industrial Average (DJIA), and the NASDAQ Composite.

- Calculation Methods: Indices are calculated using different methodologies, including price-weighted, market-cap-weighted, and equal-weighted approaches. For example:

- Price-Weighted Index: The Dow Jones Industrial Average (DJIA) gives more weight to higher-priced stocks.

- Market-Cap-Weighted Index: The S&P 500 weights companies based on their market capitalization, meaning larger companies have more influence.

- Benchmarking: Investors and fund managers use indices to benchmark the performance of their portfolios. For instance, if a portfolio outperforms the S&P 500, it’s considered to have outperformed the broader market.

- Types of Indices: There are various indices for different markets and sectors, including:

- Broad Market Indices: Like the S&P 500 or Russell 2000.

- Sector Indices: Focused on specific sectors like technology (NASDAQ-100) or energy.

- Global Indices: Like the MSCI World Index, tracking international markets.

Major Stock Indices Around the World

- S&P 500: Tracks the performance of 500 large-cap U.S. companies and is considered one of the best representations of the overall U.S. stock market.

- Dow Jones Industrial Average (DJIA): Tracks 30 large, blue-chip U.S. companies and is often seen as a barometer of the U.S. economy.

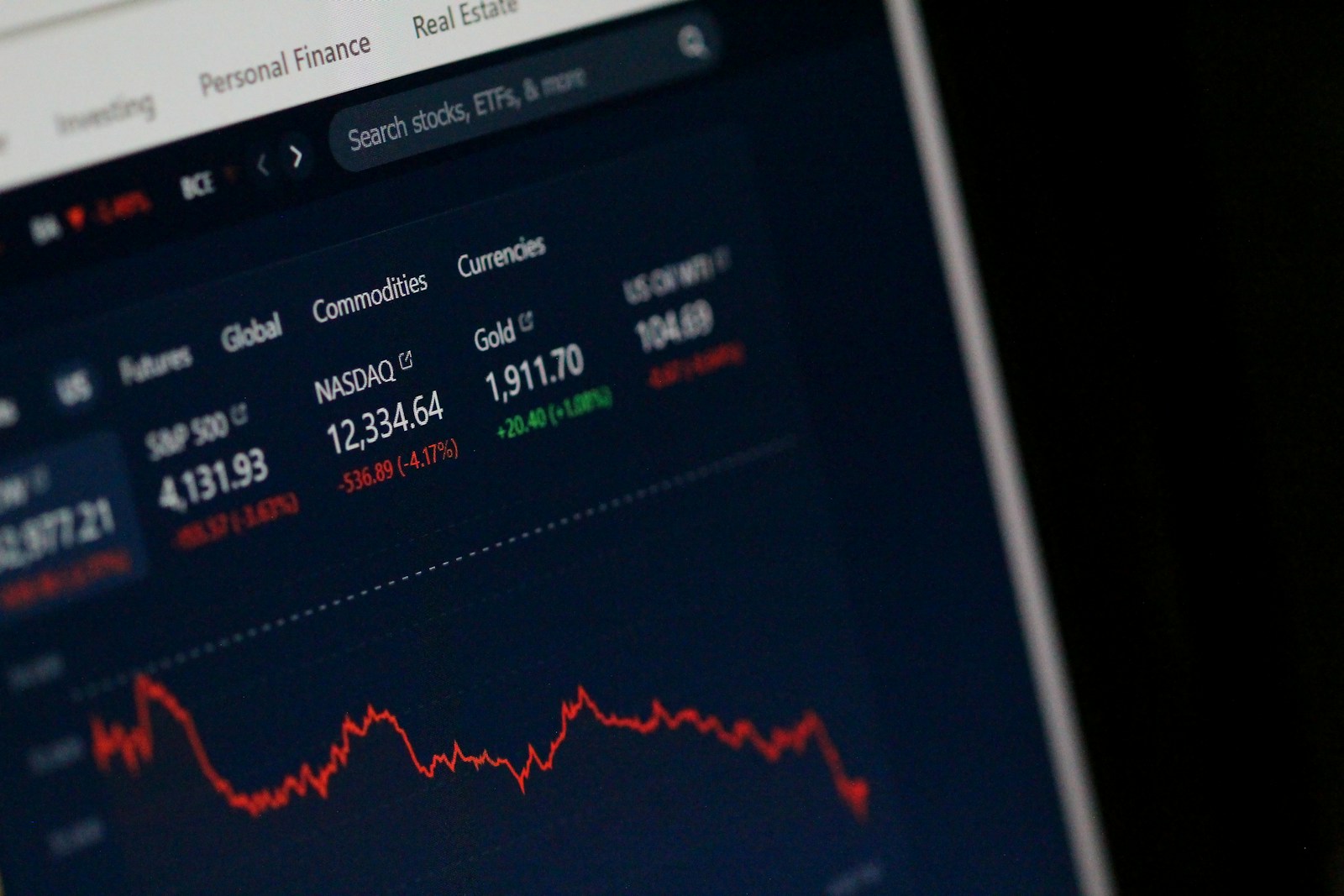

- NASDAQ Composite: Tracks over 3,000 stocks listed on the NASDAQ, with a heavy focus on technology companies.

- FTSE 100: Tracks the top 100 companies listed on the London Stock Exchange.

- Nikkei 225: Tracks 225 large companies listed on the Tokyo Stock Exchange.

Role of Stock Indices in the Financial System

Stock indices are crucial for:

- Market Analysis: Providing insights into the overall performance of the market or specific sectors.

- Performance Benchmarking: Offering benchmarks for mutual funds, ETFs, and other investment vehicles.

- Index Investing: Enabling passive investing strategies through index funds and ETFs that aim to replicate the performance of an index.

Major Differences Between a Stock Exchange and a Stock Index

1. Definition and Function

- Stock Exchange: A marketplace where securities are bought and sold. It provides the platform for trading and ensures liquidity and transparency in transactions.

- Stock Index: A statistical measure that tracks the performance of a group of stocks. It serves as a benchmark for market performance and investment strategies.

2. Structure and Composition

- Stock Exchange: A physical or electronic location where securities are traded. It lists a wide variety of securities, including stocks, bonds, ETFs, and derivatives.

- Stock Index: A selection of stocks chosen to represent a specific market segment or the overall market. It does not involve direct trading but rather tracks the price movements of the included stocks.

3. Market Participation vs. Market Measurement

- Stock Exchange: Allows direct participation in the market by facilitating trades between buyers and sellers. It is where you can buy or sell shares of companies.

- Stock Index: Measures and tracks market performance without involving actual trading. Investors cannot trade indices directly but can invest in index funds or ETFs that replicate the performance of the index.

4. Price Discovery vs. Performance Benchmarking

- Stock Exchange: Plays a crucial role in price discovery by matching buy and sell orders based on supply and demand.

- Stock Index: Provides performance benchmarks to gauge how the market or a particular segment is performing.

5. Role in the Investment Strategy

- Stock Exchange: Integral for active traders and investors who buy and sell individual securities.

- Stock Index: Commonly used by passive investors who seek to replicate the performance of a specific index through index funds or ETFs.

How Stock Exchanges and Stock Indices Interact

Although distinct, stock exchanges and stock indices are interconnected. Stock indices typically track stocks that are listed on specific stock exchanges. For example, the S&P 500 tracks companies listed on the NYSE and NASDAQ. The performance of indices is directly influenced by the trading activity on these exchanges. Additionally, stock exchanges often create and maintain their own indices, such as the NASDAQ Composite or the NYSE Composite Index.

Conclusion: Understanding the Difference

The difference between a stock exchange and a stock index is fundamental to understanding how financial markets operate. A stock exchange is a marketplace where securities are bought and sold, facilitating liquidity and enabling companies to raise capital. A stock index, on the other hand, is a benchmark that measures the performance of a specific set of stocks, providing insights into market trends and helping investors track and compare performance.

Both play critical roles in the financial system but serve different purposes. Whether you’re trading stocks on an exchange or investing in an index fund, knowing the distinction can help you make better-informed investment decisions.